CHICAGO, IL (May 21, 2018)

Goldman Sachs published an article today (Goldman: Don't worry about rates until the 10-year yield nears 4%) about the potential negative impact of rising interest rates on stock valuation. Since investors consider the 10-year treasury a safe-haven investment, the 10-year yield rate is viewed as the baseline for all other investments. The expected yield rates for other investments will be higher than the 10-year yield rate in proportion to the additional risk that the market perceives in these investments. This applies to all types of investments including stocks and commercial real estate.

For example, an analysis of twenty-eight new Dollar General investment sales that occurred between March 2014 and March 2018 indicated that they sold at capitalization rates ranging from 6.50% to 7.20% with a mean of 6.79%; a median of 6.80%; and a mode of 6.50%. These capitalization rates are sensitive to changes in the 10-year yield rate, as can be seen in the following graph:

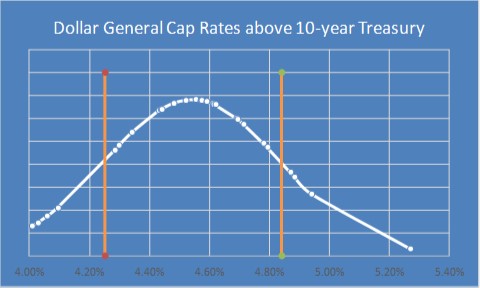

While there is not a perfect correlation between the 10-year yield rates and the Dollar General capitalization rates, there is clearly a noticeable relationship between the two. The following distribution curve shows that one standard deviation of these sales is found in a range between 4.25% and 4.84% above the 10-year treasury rate.

68% of New Dollar General Investment Sales will be between 4.25% and 4.84% above the 10-year Yield Rate

Dollar General sales have been flirting with 7.00% capitalization rates since mid-2017. With a 10-year yield rate currently at 3.07%, capitalization rates for new Dollar General stores can be expected to consistently climb above 7.00% with some sales in the 7.25% to 7.50% range. The impact of just a 15-basis point increase in capitalization rates would be to lower the value of current properties by approximately 2.14%. For future Dollar General stores a 15-basis point increase in capitalization rates would put upward pressure of approximately 2.23% on store rents.

While Goldman Sachs assures us that we do not need to worry about stock prices dipping until the 10-year rate is at 4.00%, Commercial Real Estate can expect to see negative impacts at 3.00%. Dollar General stores are just one example of the impact that increasing interest rates will have in the overall Commercial Real Estate market. As interest rates increase, we can expect capitalization rates to increase, rents to increase, and existing stock with signed leases to take a hit in value.

For DoubleTail Valuations

Jason King, MAI